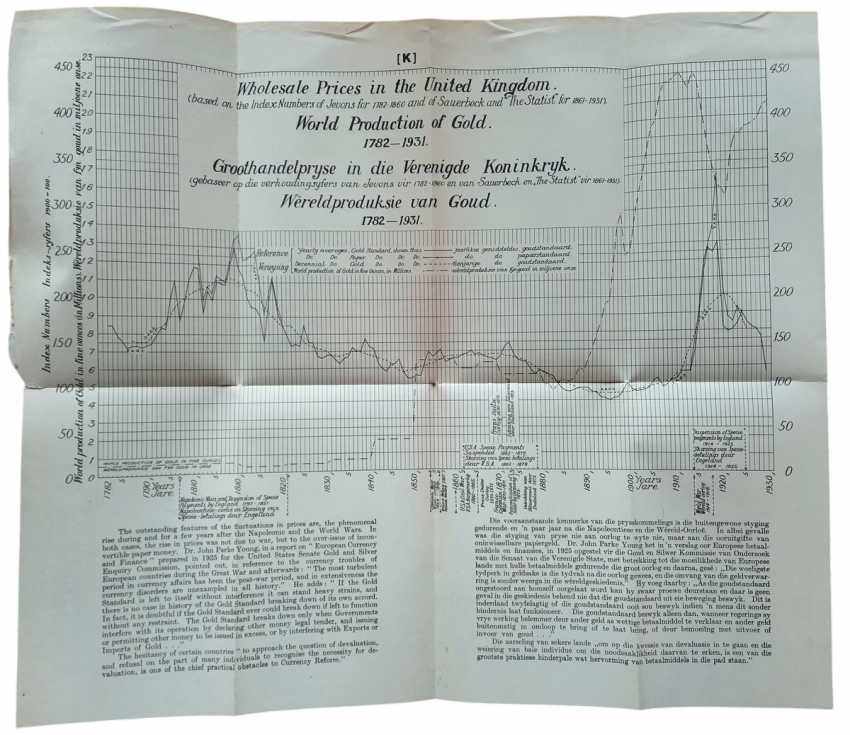

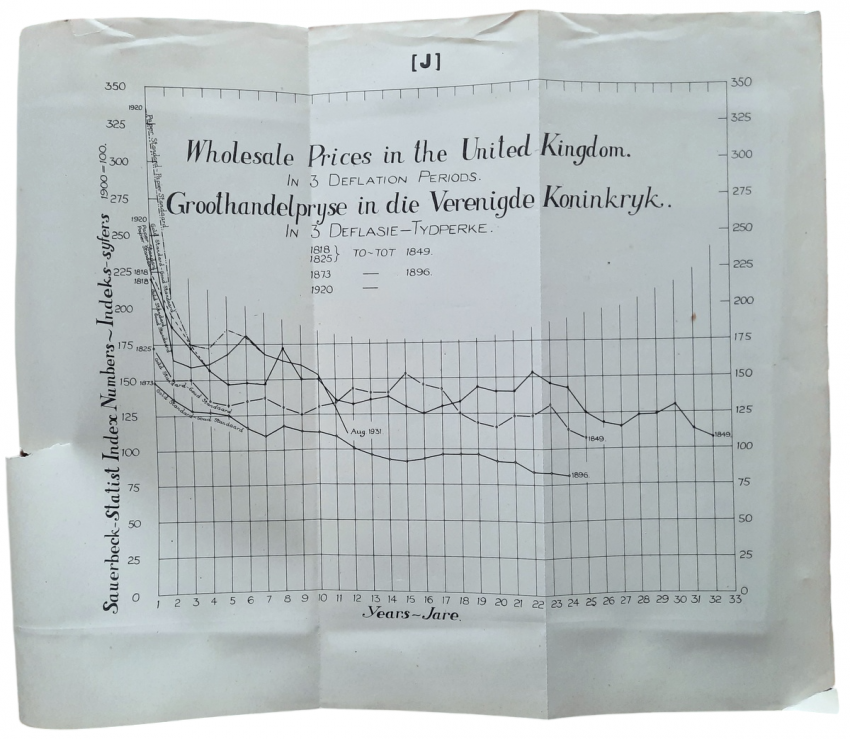

With folding chart in English and Dutch "Wholesale Prices in the United Kingdom. In 3 Deflation Periods/Groothandelpryse in die Verenigde Koninkryk. In 3 Deflasie-Tydperke" and multiple folding chart in English and Dutch "Wholesale Prices in the United Kingdom. (based on the Index Numbers of Jevons for 1782-1860 and of Sauerbeck and "The Statist" for 1861-1931). World Production of Gold. 1782-1931./Groothandelpryse in die Verenigde Koninkryk. (gebaseer op die verhoudingsufers van Jevons vir 1782-1860 en van Sauerbeck en "The Statist" vir 1861-1931). Wereldproduksie van Goud. 1782-1931" at the rear.

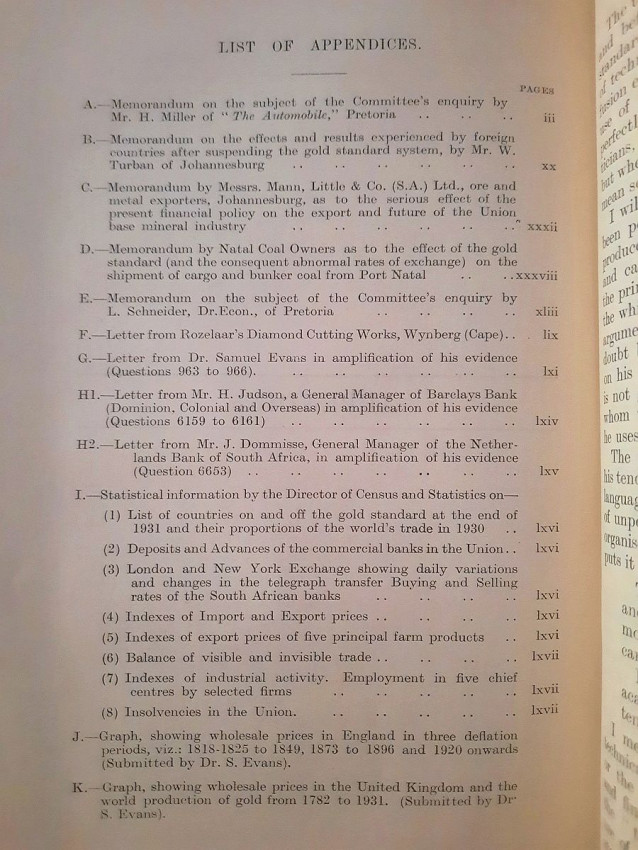

List of Appendicies:

A. Memorandum on the subject of the Committee's enquiry by Mr. H. Miller of "The Automobile," Pretoria;

B. Memorandum on the effects and results experienced by foreign countries after suspending the gold standard system, by Mr. W. Turban of Johannesburg;

C. Memorandum by Messrs. Mann, Little & Co. (S.A.) Ltd., ore and metal exporters, Johannesburg, as to the serious effect of the present financial policy on the export and future of the Union base mineral industry;

D. Memorandum by Natal Coal Owners as to the effect of the gold standard (and the consequent abnormal rates of exchange) on the shipment of cargo and bunker coal from Port Natal;

E. Memorandum on the subject of the Committee's enquiry by L. Schneider, Dr.Econ., of Pretoria;

F. Letter from Rozelaar's Diamond Cutting Works, Wynberg (Cape);

G. Letter from Dr. Samuel Evans in amplification of his evidence (Questions 963 to 966);

H1. Letter from Mr. H. Judson, a General Manager of Barclays Bank (Dominion, Colonial and Overseas) in amplification of his evidence (Questions 6159 to 6161);

H2. Letter from Mr. J. Dommisse, General Manager of the Nether-lands Bank of South Africa, in amplification of his evidence (Question 6653)

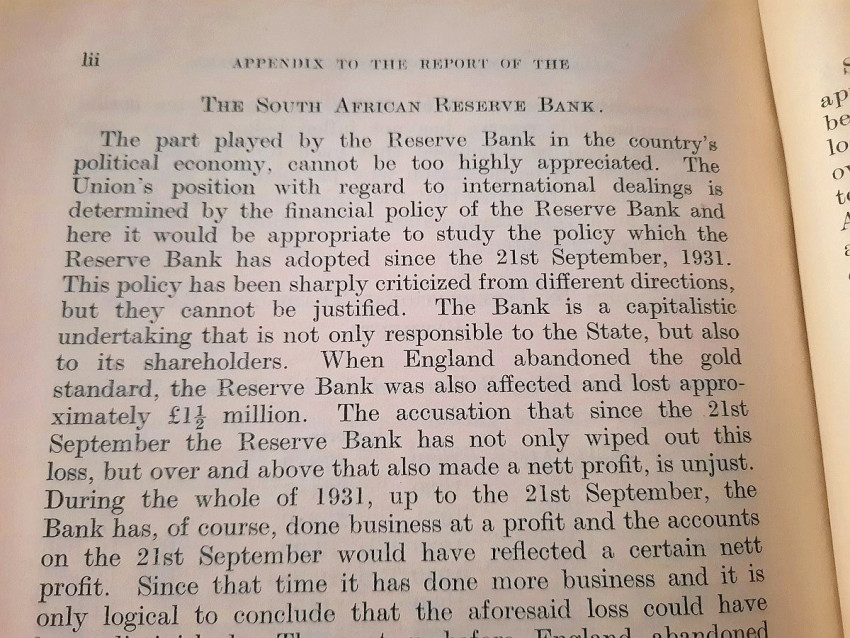

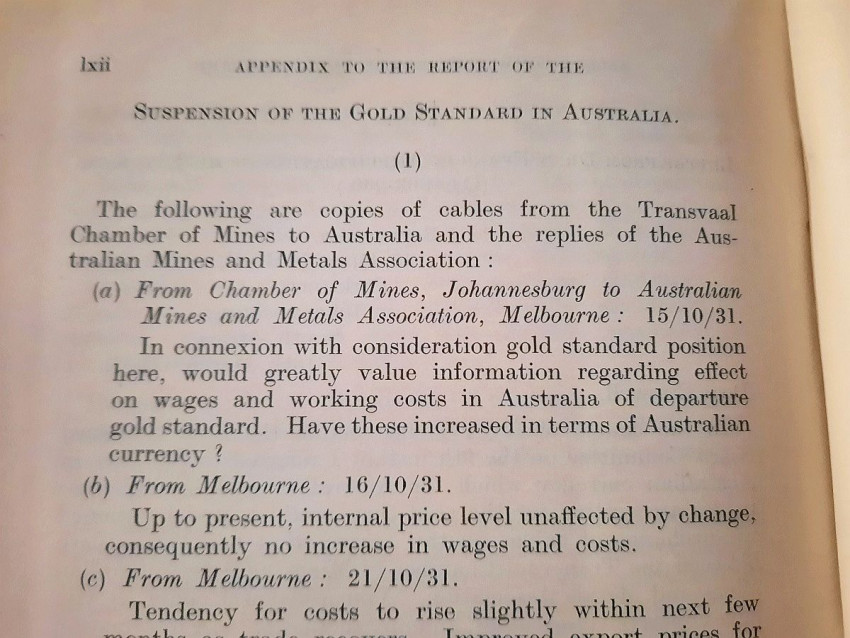

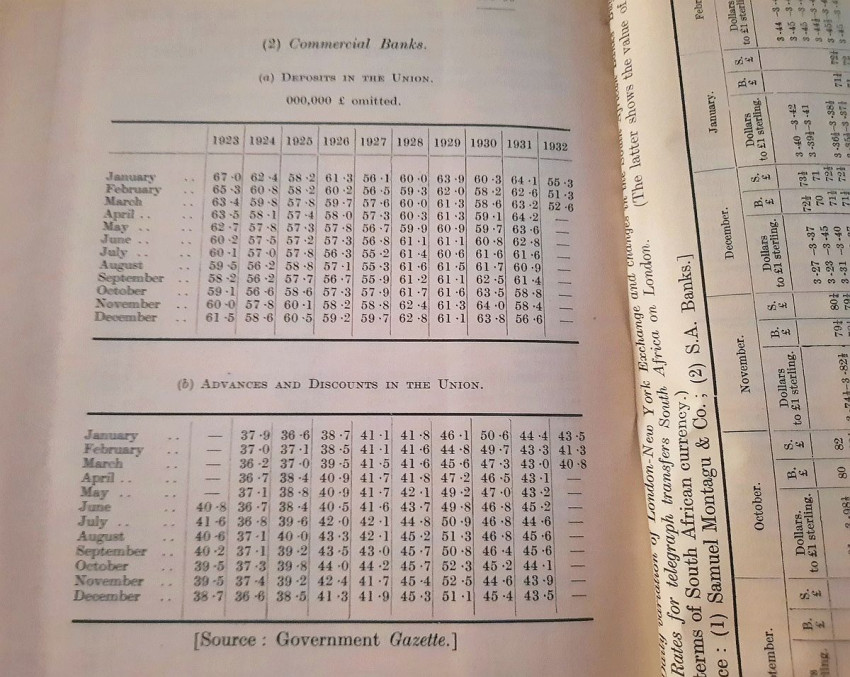

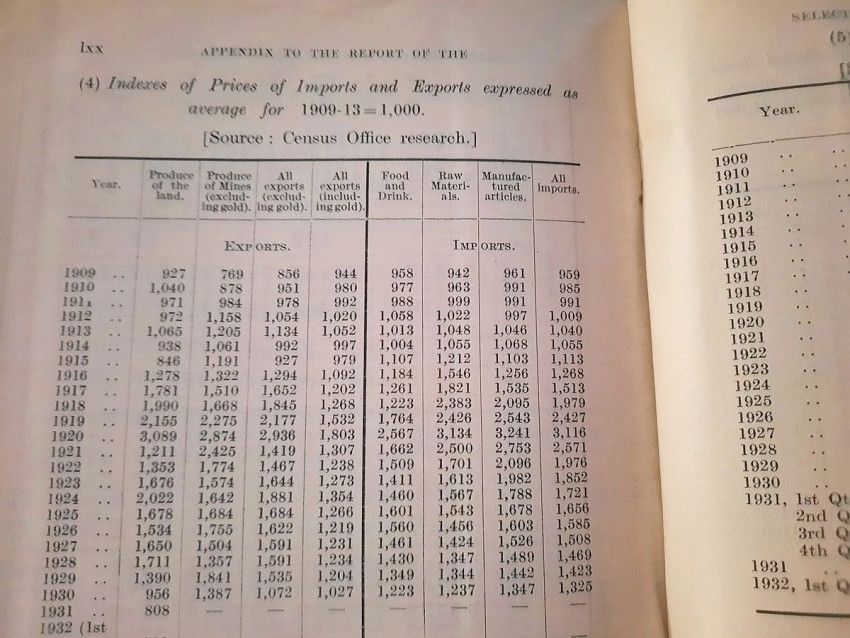

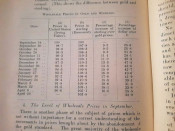

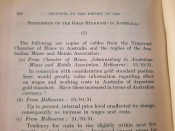

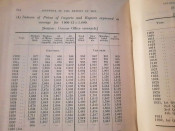

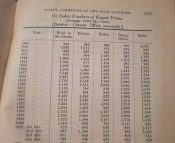

I. Statistical information by the Director of Census and Statistics on:

(1) List of countries on and off the gold standard at the end of 1931 and their proportions of the world's trade in 1930;

(2) Deposits and Advances of the commercial banks in the Union;

(3) London and New York Exchange showing daily variations and changes in the telegraph transfer Buying and Selling rates of the South African banks;

(4) Indexes of Import and Export prices;

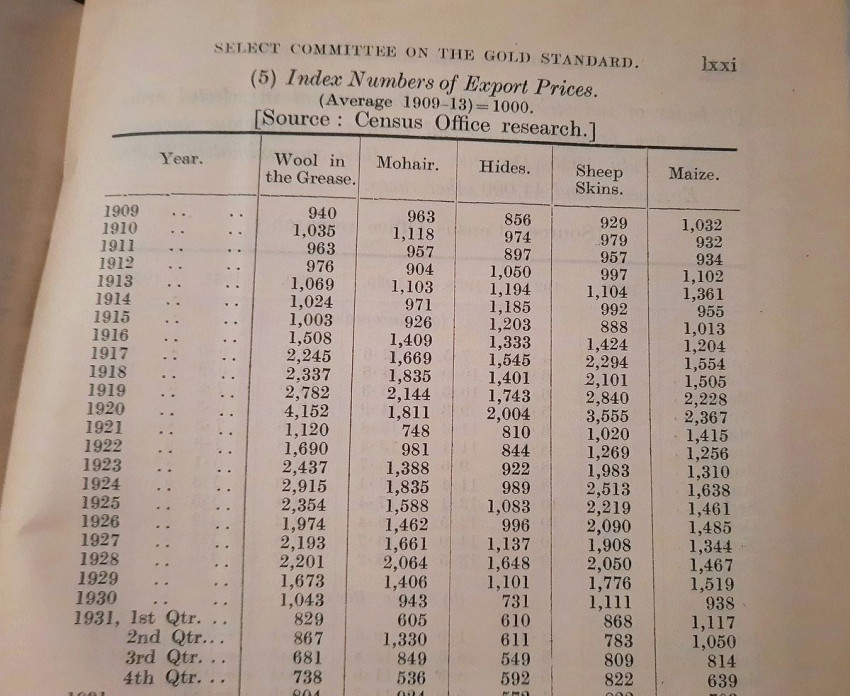

(5) Indexes of export prices of five principal farm products;

(6) Balance of visible and invisible trade;

(7) Indexes of industrial activity. Employment in five chief centres by selected firms;

(8) Insolvencies in the Union;

J. Graph, showing wholesale prices in England in three deflation periods, viz.: 1818-1825 to 1849, 1873 to 1896 and 1920 onwards (Submitted by Dr. S. Evans);

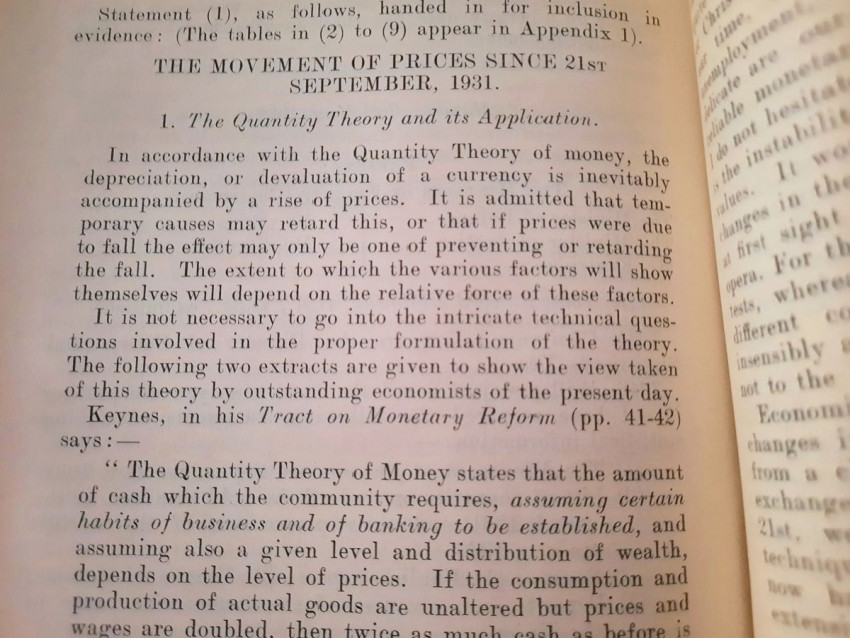

K. Graph, showing wholesale prices in the United Kingdom and the world production of gold from 1782 to 1931. (Submitted by Dr S. Evans).

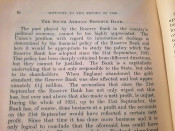

"The outstanding features of the fluctuations in prices are, the phenomenal rise during and for a few years after the Napoleonic and the World Wars. In both cases, the rise in prices was not due to war, but to the over-issue of inconvertible paper money. Dr. John Parke Young, in a report on "European Currency and Finance" prepared in 1925 for the United States Senate Gold and Silver Enquiry Commission, pointed out, in reference to the currency troubles of European countries during the Great War and afterwards: "The most turbulent period in currency affairs has been the post-war period, and in extensiveness the currency disorders are unexampled in all history." He adds: "If the Gold Standard is left to itself without interference it can stand heavy strains, and there is no case in history of the Gold Standard breaking down of its own accord. In fact, it is doubtful if the Gold Standard ever could break down if left to function without any restraint. The Gold Standard breaks down only when Governments interfere with its operation by declaring other money legal tender, and issuing or permitting other money to be issued in excess, or by interfering with Exports or Imports of Gold...". The hesitancy of certain countries "to approach the question of devaluation, and refusal on the part of many individuals to recognise the necessity for devaluation, is one of the chief practical obstacles to Currency Reform." (excerpt from the folding chart "Wholesale Prices in the United Kingdom. World Production of Gold. 1782-1931.")

Original cartonage hardcover with stripe spine; Text in English; Collation complete - Title page, [xci], 941 pages, Appendix [lxxiii], with folding chart at the rear; Ex-libris copy of the Library of Congress (Washington D.C.). Library labels to the binding spine and front paste down. Binding is tight and firm, with usual shelf wear and slight wears from the use, little bumped and discolorated. Boards little smudged and discolorated, surface partly worn, back of the spine stripe little loosen/chipped. Joints little weak, partly showing spine webbing. Text block/pages are clear and very bright, with little yellowing, no foxing or markings throughout except a four slight annotations by pencil to the title page and first two (errata) pages. Text block of the first division (the first 40 pages) vertically pressed on the left side with a visible indentation. Both folding chart at the rear present and whole, little wrinkled to the extremities, the chart "World Production of Gold. 1782-1931" detached from the text block.

IMPORTANT informations regarding shipping: Shipping to South Africa possible via national post ($40) or Fedex/DHL Express service ($120-150). Shipping to EU & UK via registered Airmail trackable parcel ($30-50). Shipping to US via DHL/Fedex ($120-180). For other countries please ask.

- Binding Condition: Good

- Overall Condition: Good

- Size: 24,5 x 15 cm

- Sold By: The Antiquarian Book

- Contact Person: Mariana Deric

- Country: Croatia

- Email: [email protected]

- Telephone: 0917552163

- Preferred Payment Methods: Paypal (no additional charges); Bank (WIRE) transfer via IBAN/BIC/SWIFT

- Trade Associations: AA Approved